About MESPT

- Micro Enterprises Support Programme Trust, Tausi Lane 01, Westlands

- Nairobi P.O Box 187 - 00606 Kenya

- +254 722 207905 / 735 333154

- info@mespt.org

Thirty-seven newly trained champions are now equipped to drive financial empowerment for small-holder farmers and micro-enterprises across the country.

From 2nd to 6th February 2026, Micro Enterprises Support Programme Trust (MESPT) successfully conducted a five-day Financial Literacy Training of Trainers (ToT) at Golden Tulip Hotel, bringing together 37 participants drawn from 17 financial intermediaries operating across Kenya.

The participants represented a diverse mix of microfinance banks, SACCOs, and development finance institutions, including Caritas Microfinance Bank, ECLOF Kenya, Suluhu Sacco, Siraji Sacco, and Yehu Impact Limited institutions among others that play a critical role in extending financial services to smallholder farmers and micro-enterprises at the grassroots level.

The training forms part of MESPT’s broader strategy of working through financial intermediaries to ensure that credit extended to smallholder farmers and micro-enterprises is not only accessible but also used productively. By strengthening financial management skills, MESPT aims to improve livelihoods, strengthen enterprises, create employment, and drive sustainable economic growth.

Beyond individual learning, the ToT was intentionally designed to build institutional capacity. Participants were equipped with practical skills to cascade financial literacy within their organizations and to the communities they serve. By strengthening financial knowledge at both institutional and community levels, MESPT is contributing to a virtuous cycle of responsible borrowing, reduced loan defaults, stronger credit portfolios, and measurable socio-economic impact.

Speaking during the training, MESPT’s CEO commended the approach taken throughout the workshop:

“We are encouraged by the participatory methodologies adopted throughout the workshop and the strong emphasis on adult learning principles, experiential exercises, and micro-training sessions. These approaches ensured that learning was not only theoretical but practical and applicable. It is evident that participants are leaving this workshop not only informed, but fully prepared to cascade knowledge, mentor additional trainers, and embed financial literacy within their institutions and communities for long-term sustainability.”

Participants echoed these sentiments, highlighting the relevance and practical value of the training.

Purity Tedora, Training and Development Lead at ECLOF Kenya, noted:

“This training will not only impact our company, but will bring massive change to our clients.”

Richard Muli from Suluhu Sacco emphasized the central role of financial institutions in enterprise growth, stating:

“Without financial institutions, business growth would be very slow.”

For Paul Kagunda, Branch Manager at Yehu Impact Limited, the training delivered immediately applicable tools:

“I look forward to impacting my networks with the skills I have gained from the workshop. I picked up key lessons on session planning, time management, effective use of training materials, and the importance of sticking to the training manual to ensure content remains relevant to the audience.”

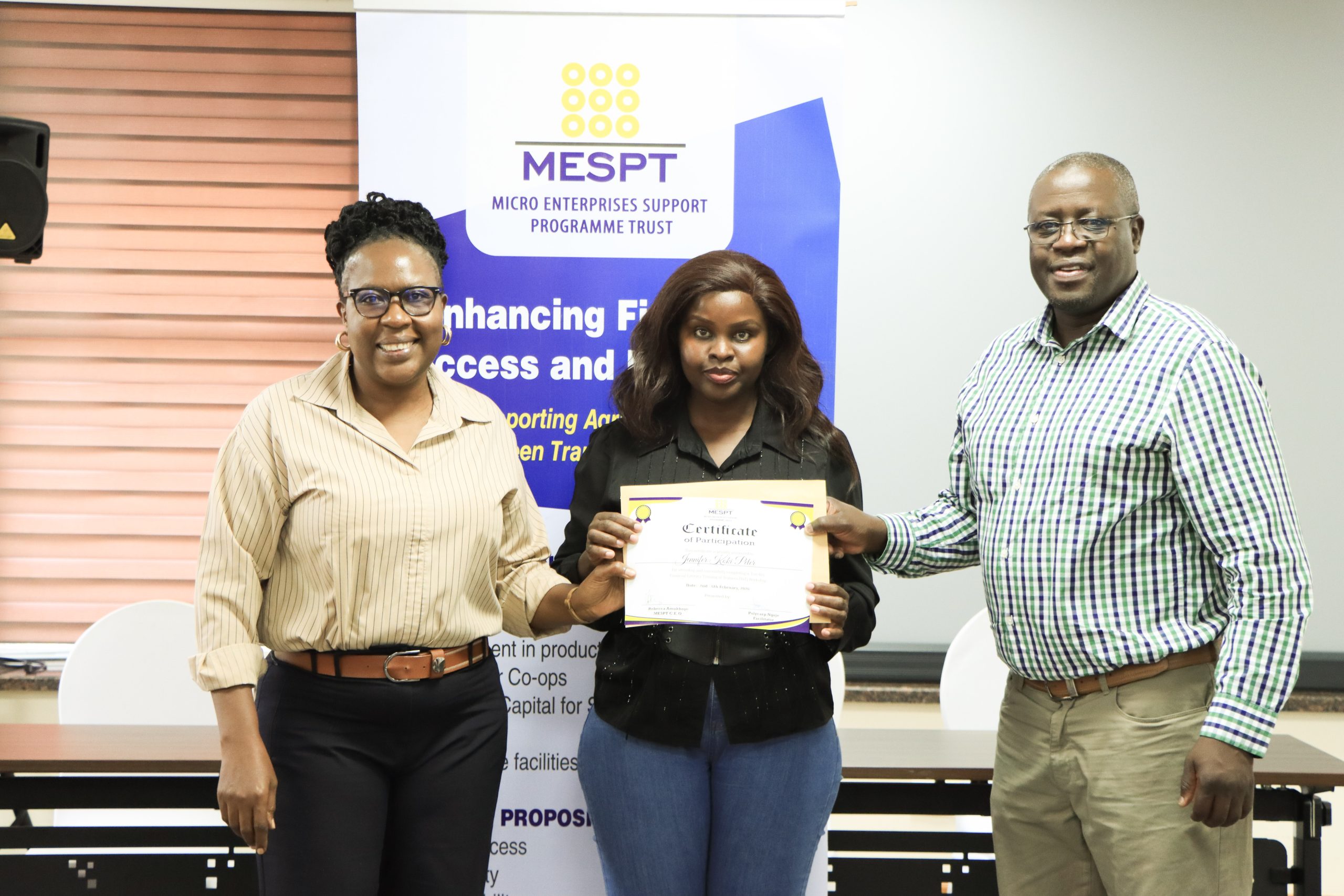

At the close of the workshop, all 37 participants received certificates of participation, formally recognizing them as Financial Literacy Champions ready return to their institutions and communities to drive transformative change.

Through initiatives such as this Training of Trainers, MESPT continues to strengthen financial systems from within empowering institutions, supporting enterprises, and improving livelihoods for smallholder farmers and micro-entrepreneurs across Kenya.